Unraveling the psychology behind luxury consumption.

Unraveling the psychology behind luxury consumption.

When you think of ‘luxury’ what comes to mind? Is it limited-edition champagne? A spa day? A Porsche Cayenne?

Paper clips?

As the term ‘luxury’ continuously redefines itself, so does the luxury market and, with it, the luxury consumer.

Luxury brands have a pretty fixed idea of what luxury is and how to sell it. But if you work in luxury retail, I’m here to tell you to throw all your preconceived ideas out the window.

In 2021, modern luxury shoppers have disrupted tradition. Tends have changed the face of product-demand. On top of it all, COVID-19 has shifted people’s buying behavior.

Against this volatile but dynamic backdrop, we’ve put together a Luxury Report to help you navigate the psychology of your luxury shoppers.

This article condenses our findings. It will answer the question “who is the luxury consumer?” from the perspective of consumer psychology, so you can have a better idea of who you’re targeting in 2021 and beyond.

For more information about the state of the luxury market today, including detailed emerging trends, read our Luxury Report.

Good question. But before we start analyzing the psychology of your customers, we first have to look at their contexts. This will help to answer the question: Who is the luxury consumer?

Compared to the traditional luxury consumers of the 19th century (Westerners, elite, upper-class), luxury shoppers are now defined by youth culture: GenZ and Millennials.

These are high-earning millennials who aren’t rich yet. Or, in other words, HENRY’s (High Earners, Not Rich Yet).

So where do HENRY’s come from?

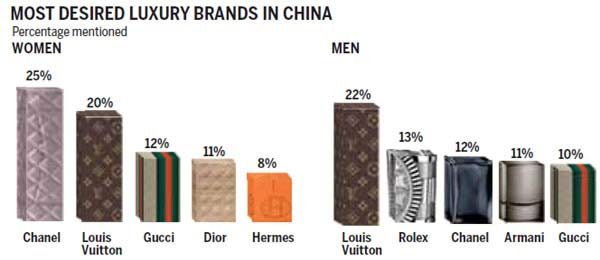

Asian shoppers drive global luxury growth. By 2025, Chinese luxury consumers will account for 50% of global luxury spending. Luxury spending in the U.S, Italy, Japan, and France is also on the rise.

ForwardPMX also found some interesting demographic results:

Moreover, HENRYs don’t actually ‘feel’ rich: They have high debt, little savings, and are working full-time. Plus, the COVID-19 pandemic has caused HENRYs to tighten their purses. They account for 35% of the market but are expected to make up 50% by 2025.

So what makes this modern demographic of luxury shoppers tick and click?

Where demographics reveal the where and who, psychographics reveal the why. Why do the Chinese buy luxury goods? What’s so appealing to GenZ about premium brands? Why do HENRYs like spending big?

Of course, I can’t give you all the answers in a single post. However, if you do want a more extensive answer, see the Luxury Report by clicking the CTA at the end of this article.

What I can offer you today is a sneak peek of our research and insights. Here’s a summary of the psychographic behavior of the modern luxury shopper:

Compared to the spenders of the ‘old’ luxury elite, HENRY’s prefer to be more conspicuous about their purchases. This means they like brands that are more discreet about their luxuriousness.

For instance, they won’t throw lavish Gatsby-ian parties or choose products where the brand name is visible (e.g., D&G belts, Louis Vuitton bags). Instead, in an era moving towards social equality, most modern luxury shoppers don’t want to show off their expensive purchases.

Bottega Veneta bags are classically inconspicuous (i.e., discreet).

Fendi is an example of a conspicuous brand because their logo and aesthetic are obvious.

Of course, many millennials still shop from Fendi. Most prefer discreet brands, but not all. That’s the main caveat: Every brand or retailer will have a different target audience.

Yet while there is no one-size-fits-all approach to navigating luxury consumer psychology, there are a few psychological clusters that your customer segments likely fall under.

These are:

Psychographics and psychology go hand in hand. So, without further ado, let’s jump into the psychological processes behind spending big.

The need for uniqueness

The need for uniquenessPsychologists and researchers agree that one psychological trump-all for buying a luxury product is the need for uniqueness. This is based on the “uniqueness theory” which suggests that individuals tend to want to be dissimilar to others and will try to show how they’re different.

The need for uniqueness in luxury consumption works on two levels:

|

Personal Level |

Brand Level |

|

Differentiation Individuality Self-expression |

Innovation Tailored/custom experiences Unique offering Belonging to the “in-group” |

Many individuals will feel drawn to luxury brands to represent how they are different. But to cater to this, you should strike a balance between offering unique products in an exclusive way, without making your customers feel like outsiders.

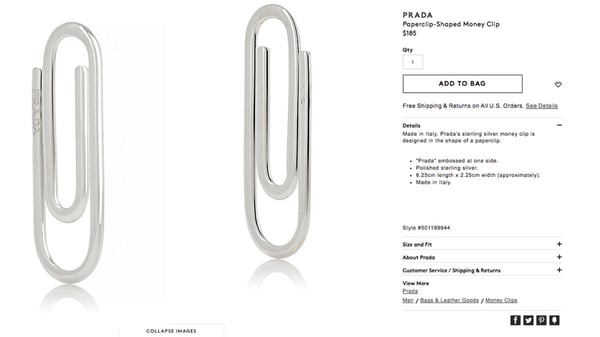

In other words, you need to balance uniqueness on both a personal and brand level to succeed. There’s a fine line between unique and too niche. Like Prada’s paper clips: Social experiment or actual purchase?

CNN: Prada’s paper-clip sparked outrage.

While it’s great to be unique, it’s never a good idea to provide products totally isolated from trends, styles, or your audience. That’s why having a strong brand legacy and being exclusive go hand in hand with this psychological principle (at the end of the day, it’s all about trust).

This psychological process will most likely stick around.

As the luxury landscape tilts towards accessibility, consumers will want to stand out both on a personal and brand level, prompted by the behavior of the in-group (other luxury shoppers).

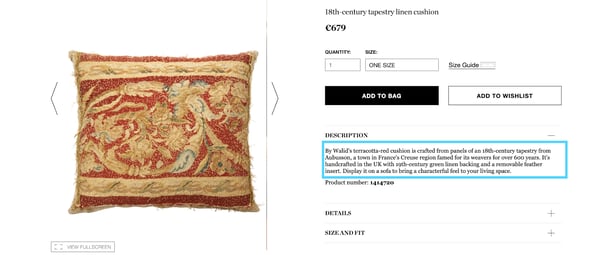

Even for “new-to-the-scene” brands, you can highlight your legacy by indicating the craftsmanship of your products. Creating stories around your products in your product detail page is one way to highlight the legacy of your offering, like By Walid does for their vintage products.

Telling stories in your PDP is also a good way to show how your products are unique. You could also optimize your Google Ads with legacy messaging as PRADA does.

Porsche also uses Twitter to show how timeless and iconic their products are.

It doesn’t matter what products you’re selling - pillows, bags, cars - maintaining a brand heritage doesn’t mean being so exclusive you can’t participate in social media or digital innovation.

Luxury brands that succeed in appealing to the new consumers’ need for uniqueness actually break down the barriers between their high-end products and the shopper’s real-time buying experience.

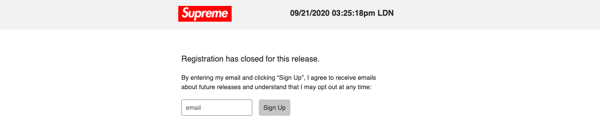

Another way to appeal to the need for uniqueness on both a personal and brand level is leveraging Exclusvitiy Scarcity in your marketing and messaging.

This is the psychological principle that people will respond to things that are exclusive, scarce, limited, or rare.

For example, Net-a-porter gives privileges to their members, and Gucci provides member-only access to their latest collections.

Your loyalty programs can leverage uniqueness by offering:

Another fun way to leverage Exclusivity Scarcity is by creating hype around your anticipated product lines. For example, Supreme sneakers become exclusive even before they’re ‘dropped’.

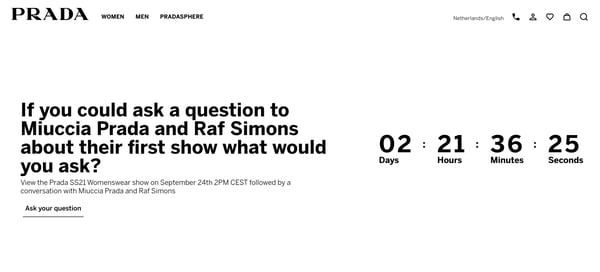

PRADA also leverages this psychological principle online by using a countdown timer on their homepage. Unlike fast-fashion countdown timers, however, PRADA also shows Authority with their ‘ask the designers’ campaign.

This is a great way a luxury brand is appealing to the digital-natives HENRYs, whilst still remaining true to their brand legacy by using Authority and Exclusivity.

You could also leverage Exclusivity Scarcity on your webshop PLP by using product badges, which are nudges that point out your most appealing products (Dynamic Badges like “Premium” or “Exclusive” on your products will drive behavior from the PLP to PDP).

But keep in mind that Dynamic Badges are often conspicuous, so it’s about designing your badges to be inconspicuous.

These subtle, implicit nudges will work better for luxury consumers. Want to know more about employing nudge theory on-site? Read this ebook for more about nudge marketing.

Costly Signaling and Status

Costly Signaling and Status

Evannex: “Another happy Tesla family with their model 3”

Many of your customers used to shop for luxury products because it made them stand out. A Louis Vuitton bag is conspicuous - it has the brand name and logo written all over it and is explicitly lavish.

Conspicuous products signal wealth and status. This is called Costly Signaling and Status and is a psychological theory that suggests people will buy luxury goods explicitly to show how they are part of an in-group of wealthy, luxury connoisseurs.

How Louis Vuitton became the celebrity luggage brand of choice

But in 2021, the new luxury consumer rejects conspicuousness.

In fact, in a report by High Snobeity, only 6% stated they purchased a luxury product as a direct expression of their wealth.

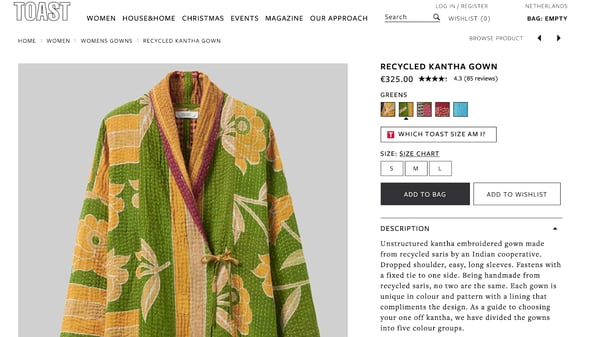

Instead, shoppers are buying from brands that are more discreet. Coupled with the emerging trend of “quiet luxury”, luxury consumers are finding new ways to signal their wealth and status: Sustainability.

TOAST recycled luxury

This kind of ‘prosocial signaling’ is a way luxury consumers can show off their status and belong to an in-group of pro-environmentalist shoppers. The theory suggests they will explicitly buy products with green labels - like electric cars - to signal how they’ve paid a higher price point for quality products.

“When both the market and offering (amount of luxury items) are increasing,” explains Chief Behavioral Officer at Crobox Joris Fonteijn, “you get more diversification (specific products that fit the needs of specific segments). Less conspicuous products just make people work harder for others to see them...The people that matter (the in-group) respect it more because they “get it” whilst the rest may not see it.”

Sustainability is no longer a nice-to-have but a must-have. However, it’s not just about pledging to ‘go green’. You need to demonstrate the concrete efforts you’ve made towards these goals, from your supply chain to frontend campaigns.

Moncler, for example, has a separate section on their webshop dedicated to their sustainability plans. They budget for sustainability and are transparent about how they plan to achieve their goals.

If you want to show your sustainability efforts, provide proof of your ethical score like Voz does. For example, Gucci has also recently partnered with The Real Real to tap into the second-hand clothes market.

Which is very disruptive for a luxury brand, especially one that has stayed far away and even spoken against consignment and resale before.

The sustainable luxury brand Fool Dost doesn’t just advertise using sustainable materials (although this is one of their USPs). They’ve partnered with MasterG India to promote a more ethical and eco-friendly system of manufacturing garments. The organization empowers women and the use of ethical, fairtrade materials for fashion.

Nomasei is a sustainable luxury shoe brand that empowers local designers.

The takeaways?

Building the self and self-narrative

Building the self and self-narrative

PROUD Athletics luxury brand.

As we’ve seen throughout this article, luxury purchases help individuals construct a self-narrative of status, wealth, or uniqueness. They are symbolic purchases that bring individuals closer to their ideal perceived self.

But sometimes, if the product doesn’t bring the individuals closer to this ideal self, they become disenfranchised with the purchase or brand.

Think of it this way: I buy a Porsche because I think it will make me appear wealthy, classic, and obtain a certain status. This anticipation of the reward triggers dopamine.

But after I actually obtain the Porsche, I’m disappointed that I have embodied none of the things I thought would make me a better person.

This counters the benefits of dopamine. Plus, I now have a ridiculously expensive car that reminds me of this conflict of selves. This has been called “imposter syndrome for luxury consumption” and causes psychological friction in:

a) building up the real self

Now, this might seem like a lot of psychological fluff to you. But understanding your customer’s buying behavior always starts with these kinds of psychological concepts.

Which begs the question: How do I apply this?

In order to counter some of the psychological stress of imposter syndrome, you should nurture the relationship between your customers and brand. This is important to make your customers feel worthy of their purchases so that you’re fostering excitement and pleasure beyond that momentary release of dopamine.

According to our Chief Behavioral Officer here at Crobox,

“If luxury retailers can foster and build relationships with their individual customers post-purchase, then they can make their brand a safe space where shoppers will feel worthy of belonging to the in-group, and not imposters. Plus, nurturing customers will more likely increase the possibility of a second purchase.” -Joris Fonteijn

A couple of ways you can nurture luxury customers:

Luxury consumers pay premium prices for luxury goods. Fact. But the modern luxury consumer needs these prices to be justified. Also a fact.

So what do you do to cohese this mental conflict?

One way of justifying your premium prices is by highlighting the quality of your products. In fact, 39.1% of consumers say the one thing that draws them the most to a luxury brand is quality.

But you also need to stay discreet - i.e., you don’t want to shout from the balconies that you’re using real leather or real diamonds. Trust me, this won’t fly in the twenty-first century.

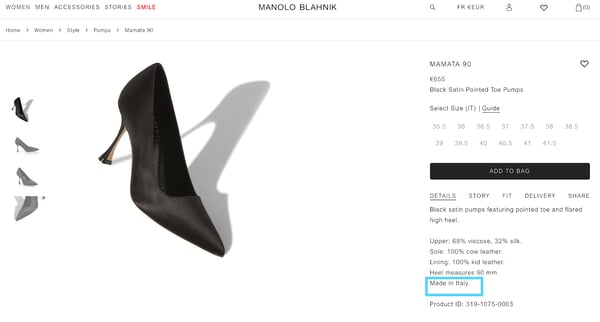

YSL and Manolo Blahkin, for example, infer the premium quality of their shoes by putting the country of origin, “Made in Italy”, in their product description.

According to the BCG Report, this will cater to the needs of the luxury consumer that is characterized by temperance, slow fashion, and inconspicuousness.

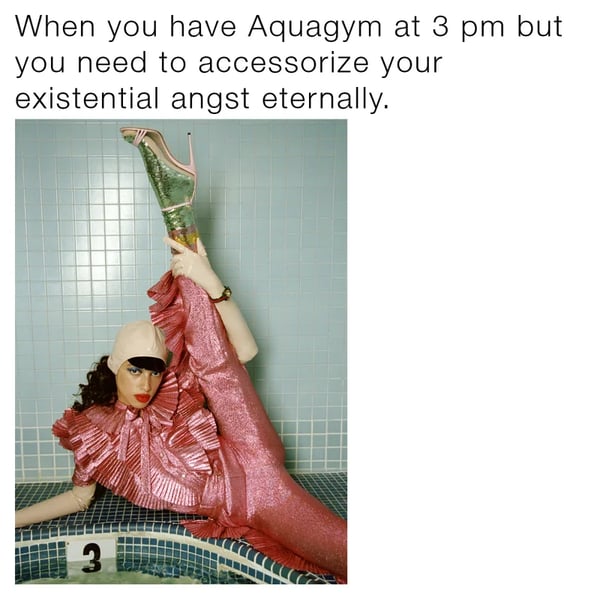

#TFW Gucci’s Instagram campaign archive

What we’ve seen throughout this article is that luxury marketing is moving away from the “unattainable self”. Instead, luxury marketing constructs a self that is aspirational: Midway between desirable and realizable. By understanding this behavior, you can begin to communicate a self that is attainable whilst still remaining exclusive as a brand.

For example, Gucci’s meme campaign closes the gap between catwalk high-fashion and everyday shoppers. This strategy works twofold:

Gucci also worked with local artists to get their successful meme campaign rolling. Collabs between luxury brands and designers, artists, or smaller retailers are changing the game. Consider collaborations as a strategy towards becoming more relevant.

This is how Gucci, among others, have managed to stay customer-centric in a market where imposter syndrome often occurs. They construct an aspirational self that catches up with L’oreal’s famous tagline “because you’re worth it”.

In the end, it’s about making your customers feel worthy of their purchases.

L'oreal 2020 twitter campaign

In 2021 and beyond, you have to change the traditional way of marketing your luxury products. The luxury market is fragmented and volatile. Your shoppers have dynamic spending habits. And on top of it all, your top-spenders are no longer the same as they used to be, demographically or psychographically.

That’s why it’s so important to understand the psychological processes behind buying luxury goods. To recap, these are the psychological clusters that many of your customers will likely fall under:

If you’re flexible, open to change, and customer-centric, you will easily reap the benefits of these 2021 opportunities!

For more on these topics, read our Luxury Report: