Looking at the athletic footwear market through the lens of market data and behavioral psychology.

Looking at the athletic footwear market through the lens of market data and behavioral psychology.

Are you selling activewear? Or maybe you’re a sports fashion retailer looking to enter the athletic footwear market?

You’re not alone.

Even luxury brands are now selling sneakers. And even if you’re selling other products but in an eCommerce environment – there are crucial lessons you can take from the athletic footwear market.

That’s because the rise of athletic footwear in recent years has represented eCommerce growth, expansion, localization, and insights into consumer behavior patterns.

In our Activewear Report, we analyzed the top trending sports and activewear categories. Our category deep dive of athletic footwear showed that two product categories reigned:

In case you missed it, here's a free download to the report:

This article will look at these two categories and show why they have contributed to the growth of the athletic footwear market.

First, we’ll take a look at the athletic footwear market growth, and then the psychology behind purchasing decisions.

After all, athletic footwear is a 50-billion-dollar industry. And expected to grow by 6% every year!

Need more convincing?

Running shoes are pillars of the health and wellness trend. And sneakers? Sneakers have never been cooler than they are today.

Let’s take a look at why.

Athletic footwear is shoes designed to be worn for sports, exercise, or recreational activities. In our definition of athletic footwear, we include:

A running shoe is a high-tech sneaker designed specifically for running and usually leverages lightweight and cushioning features in the foot and heel to promote forward movement.

Sneakers are trainers that can be worn for sports OR casual occasions.

Both products are gaining in popularity and categories that will continue to do well, especially due to:

And if you don’t believe me – check out these 10 successful athletic footwear brands. They are PROOF for why we know this retail category is in it for the long haul.

According to The Trend Spotter, these are the most on-trend athletic footwear brands of the moment:

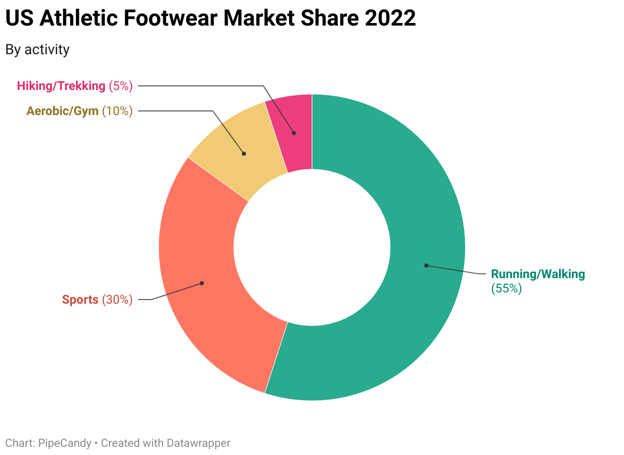

Pipecandy shows that Nike’s total share of the market in the U.S is 56%, making them a huge player, especially with their monopoly over Jordan's and Converse.

But following the legacies of Adidas and Nike are top brands like ASICS and Under Armour. Local brands like Brooks Sports and Fila which are valued at <$1B have also continued to do well in the athletic footwear market.

Running shoes are predicted to have a CAGR of 4.85% between 2022-2025.

The top brands specifically in the running vertical are Nike (valued at over $36 billion), Adidas ($16 billion), Puma, Under Armour, Reebok, New Balance, Skechers, and ASICS.

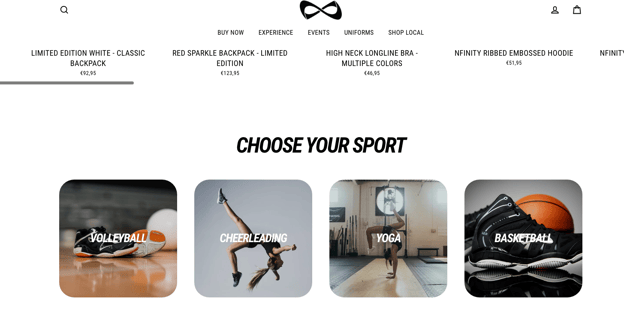

Although Nike does take home a big chunk of the pie, even non-running shoe native brands are jumping on the running trend. In the Local category, the brand Nfinity drives 144% more engagement than the category average.

Puma also launched five new lines of running products including Liberate, Velocity, Deviate, Deviate Elite, and Eternity in 2021.

“Running shoes are constantly evolving. And thanks to the continual ebb and flow of creative innovations, bizarre fads, and leaps in science and our understanding of the human body, they will continue to do so as long as humans are lacing up shoes and running for competition and recreation.” (Brian Metzler, Kicksology)

Since more people are working out outside, running seems like a simple, athletic go-to. You can run anywhere and at any time.

And the only thing you really need to go running? Good running shoes.

Imagine the sweat and breathlessness you get after a run.

Thirty minutes of just you, your breath, and your shoes slapping against pavement.

Now imagine the same sweat and breath, but this time your shoes are navigating mountain passes, climbing hills, and jumping over loose rocks.

One person’s nightmare is another person’s pleasure, I guess.

Trail running has become so popular that it’s actually witnessed unprecedented growth in the past few years.

And in 2019, the American Trail Running Association found that 83% of runners actually used trail-specific shoes.

Coupled with the rise of the outdoor apparel market, trail running validates the trend of more people – not just running – but running outdoors and over extreme natural terrains.

At Crobox, we were also able to validate how the trail running shoe market is growing.

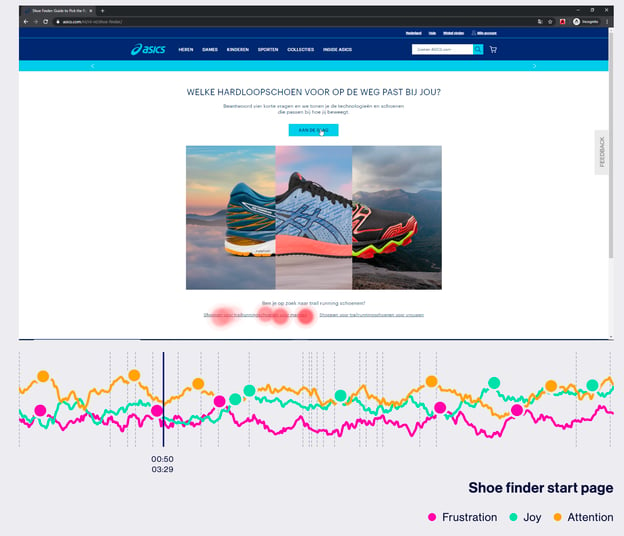

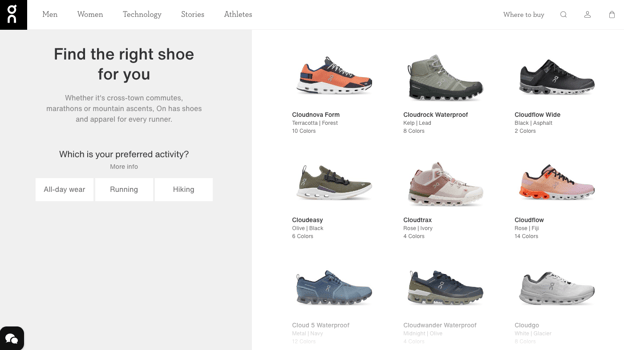

Together with the UX-research company Brangineers, we spotted the interest in ‘trail running’. This was from doing usability testing on ASICS’ Running Shoe Finder.

Braingineers tested the ASICS Running Shoe Finder using eye-tracking and EEG scanning.

And guess what?

They found that many users were missing a trail running option, as they kept trying to find one. Creating a bit of friction when they didn’t.

From these insights, ASICS was able to optimize their Running Shoe Finder, giving the option of trail running as a question in the finder flow.

And not only that, but ASICS updated their taxonomy with a Trail Running category.

Pretty cool, right?

I know you’re just dying to see this in action, so feel free to check out the whole case study here.

Using neuromarketing in this way leads to answering questions about the psychology behind purchase decisions. Since our goal at Crobox is always about understanding the why behind the buy, we asked:

Together with our behavioral psychologists and in-house activewear data, we came up with some answers.

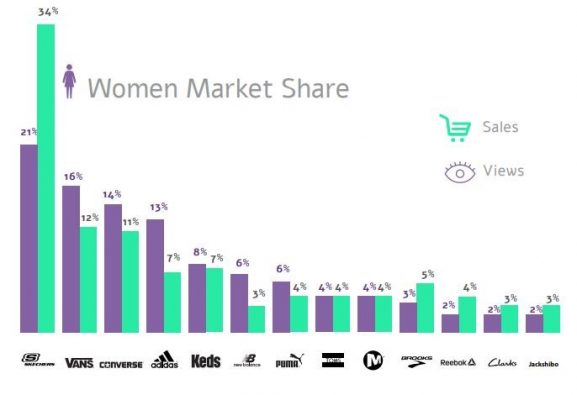

From 2014- 2017, female participation in running increased from 22% to 34%. For one of our running shoe brands at Crobox, we actually found that more men were buying single running shoe products, but women were spending more per transaction.

According to balanced running, women would spend on average $1,100 on running gear, whereas men would spend around $900, once again validating our own data.

How can we explain this gendered split?

Well, one reason can be due to representation. Historically, women have been left out of the running shoe market, creating more products marketed toward men. This could mean they take longer to make a purchasing decision, collecting more information to make a choice that fits them.

In further data we collected on one of our running shoe brands, we found that more men were completing a Running Shoe Finder than women (58% vs. 38%). Men were also more likely to look for running shoes to run on the road, instead of on a trail or track.

Sketchers is famously more popular with women than men.

But for another running shoe brand, we found that men completed the Shoe Finder more than women (drop-offs for women 85% vs. 88% for men).

The athletic footwear market (and running shoes specifically) is traditionally male-dominated. So it’s possible that these running shoe brands don’t capture the attention of women enough.

However, when a brand does a good job of capturing this female segment, women will notice, fostering loyalty and higher AOV.

Therefore, according to our data and behavioral experts:

According to Edited, the global women’s activewear market is forecasted to grow by $37 billion in the next four years. It’s time for you to get creative, by understanding the needs of your shoppers, and translating them into campaigns.

“As the fashion industry blurs the lines of what is perceived as feminine and masculine, naturally we are seeing gender neutrality take over. As the industry moves forward the sneaker industry seems to sadly stay the same. Women don’t want another pink platform sneaker, they want to see the most coveted high-heat releases dropped in an inclusive size range without the inflated price point.” - Klekt

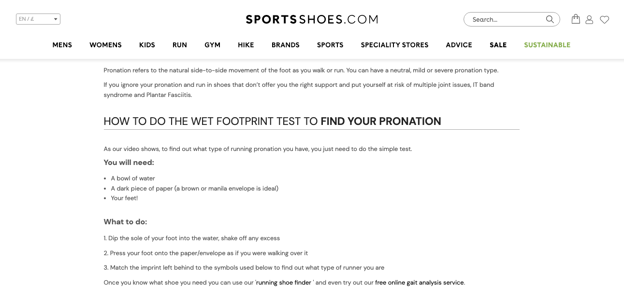

If you’re not a runner, do you know what ‘pronation’ means?

What about knowing your 'running stride'?

Even veteran runners will struggle with finding and choosing the right shoe for them, especially in an online environment where haptics (i.e., look and feel) are missing.

This makes it more important than ever to guide and advise shoppers in the running shoe market. Especially as choice overload saturates the market, with little physical differentiation between products.

You can guide purchasing decisions by leveraging Product Finders or Virtual Assistants on your webshop. Our Running Shoe Finder for ASICS, for example, saw these impressive results:

The more visual cues and aids the better. But also the more you can advise customers on what’s right for them.

“We have a unique position on the market. We can’t just be retailers who provide goods, we need to provide an additional service, including advice. That’s why using a Product Finder is a very high priority and one of the major tools for customer assistance at the moment.” - Martin Faith, eCommerce Director at Top4Sport

Basically, bringing guided selling online is really important to be able to sell running shoes in the right way. In short, in a way that:

Brooks’ Run Happy blog educates their audience with stories, workouts, and gear maintenance.

And now the moment you’ve all been waiting for: Sneakers!

The sneaker isn’t strictly an athletic footwear product anymore, not in the same way that running shoes are. But like the tennis polo, sneakers start off as activewear and go on to represent a cultural zeitgeist.

UNIQLO: The tennis polo started off as a product specific to tennis gear. Now, you can find polos in many fashion stores and worn in the street.

Zeitgeist is a pretty big deal, don’t you think?

I talked to a veteran sneakerhead, and he spoke about the symbolic importance of sneakers:

“Why do I collect sneakers? For me, opening a box of sneakers is a magical moment. Back when the sneaker craze started, they were so connected to hip-hop culture and basketball that collecting them would get you closer to this subculture. I wanted to be like Mike (Michael Jordan), so I wore sneakers. Collecting sneakers was more than just a hobby, it was a passion.” - Luca, Sneakerhead since 1986

Many consumers like Luca will place a similar importance on sneakers. Which is why their resale value is so powerful.

Be Like Mike Gatorade commercial, 1992

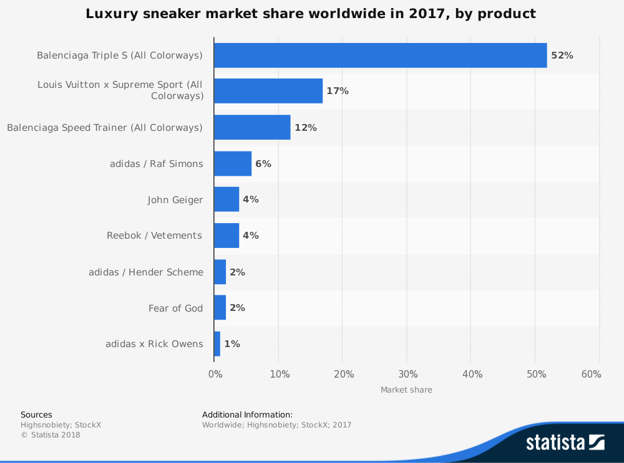

Today, consumers will opt for wearing sneakers, not to participate in sports, but to signal to others. Sneakers are such a psychologically-rich athletic footwear product, that many luxury brands have jumped on it.

Sneakers signify the ‘Self’.

By 2026, sneakers will account for a $120 billion market. According to The Times, sneakers have become such a global commodity, that GenZ consumers are making it their ‘asset of choice’.

You only have to look in the streets of Paris, the fashion capital of Europe, to notice how popular sneakers are. People pair sneakers with suits.

72% of luxury brands report sneakers as their best-selling product globally. When Air Jordan’s took off in 1985, their sale showed just how popular meshing athletic footwear with leisure could be. Today, the appeal of sneakers is largely due to the rising trend of comfort. But also things like:

Famous sneaker-celebrity collabs like Yeezy’s (Adidas x Kanye) are priced anywhere from $200 to $600. The Yeezy model 350 ranks second behind the Air Jordan for iconic shoes.

How has such a simple shoe become so popular?

It’s (y)easy: Their popularity symbolizes the sneaker market as a whole; ingrained in hip-hop culture, Yeezy disrupts traditional luxury while still cultivating scarcity.

In fact, in 2020, sales of Yeezy slides grew by 400%.

The sneaker represents the power of marketing to a subculture, and how this can transform into solidifying a brand’s legacy. You only have to look at the Air Jordan and its history to understand how vital this symbolism is.

“There is a pop-culture currency [to] footwear. For sneakerheads, there is a style of trainer for every taste and identity.” - BBC

So while the market will continue to capitalize on these behaviors, how do we explain the state of sneakerheads today?

According to research by Lux and Bug, ‘there is a complementary relationship between sneaker brands and the resale market; that product limitation is essential for value increases; that collaborations are necessary for sneaker brands to be relevant on the resale market and that the market is very fragmented.’

This means buying sneakers is based on the psychology of conspicuous consumption (i.e., signaling to the ‘in-group’ their wealth and social status).

Enter: The realm of the Veblen Good, where the more the price goes up so too does the value.

There was actually a drop in interest in Yeezy’s back in 2019 when they increased their supply!

Collaborations between luxury brands and sneakers also drive demand in this market. For example, StockX, a sneaker resale platform, showed a 200% increase in collaborations between luxury and streetwear brands from 2019 to 2021.

In the resale market, sneakers are LEGEND – wait for it – DARY. LEGENDARY.

And this we have to thank the psychological principle of scarcity for. Scarcity drives up their value. StockX generated $400 million in revenue in 2020.

Source: DJ Khaled has over 10,000 pairs of sneakers.

Scarcity is a huge psychological driver in the sneaker market. For example,

All fall under the umbrella term scarcity. According to sneakerhead Luca,

“Twenty years ago when I wore sneakers to a wedding, I felt so urban and rebellious. Now, sneakers have gone mainstream. They are now fashion items for the rich. But I still collect and resell, because there’s a financial value in it. And you can still always tell who the person is from the sneaker they wear.”

Forest Gump’s Nike running shoes

According to Lux and Bug, “in order to be relevant for the secondary market, a shoe needs to possess a quality or meaning exceeding its functional values.” The limited-edition or exclusive nature of sneakers is part of the success of storytelling.

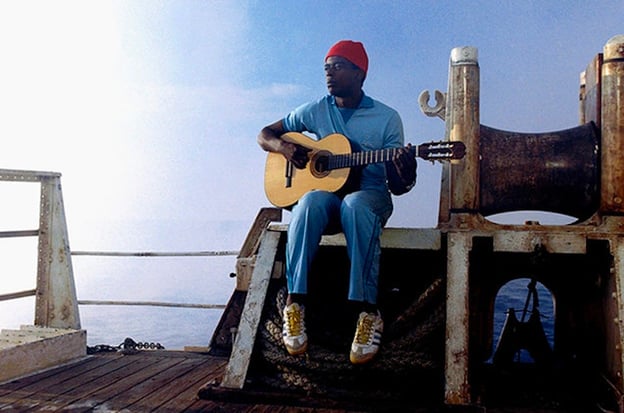

For example, Forrest Gump wearing Nike’s waffle trainers (above). Or Seu Jorgen wearing white and yellow Adidas in Wes Anderson’s film (below).

Source, ‘Life Aquatic’.

To engrain a product in the cultural zeitgeist, athletic footwear brands should master storytelling, and partner with content creators to reinforce their story.

Hence, the power of influencers.

Let's go back in time a bit.

In 1973, Walt ‘Clyde’ Frazier became the first NBA player to sign his Puma sneakers. When Michael Jordan started wearing his brand of black and red, sneakers were already interesting for marketing campaigns.

Legend has it that Air Jordans were against the NBA’s uniform rules so every time MJ entered the court wearing them he was fined $5000.

And guess who continued to pay Jordan’s NBA fines?

Nike were not only rumored to pay the fines but actually created a whole campaign around Jordan’s sneakers called ‘Banned’.

The series of commercials cemented Nike and Jordan in a kind of counter-culture and rebellion.

It was the smartest marketing move Nike made. And now, Nike is a legendary player in the athletic footwear market. All because they leveraged a powerhouse influencer, and created a story around a product.

So what’s the future of the athletic footwear market?

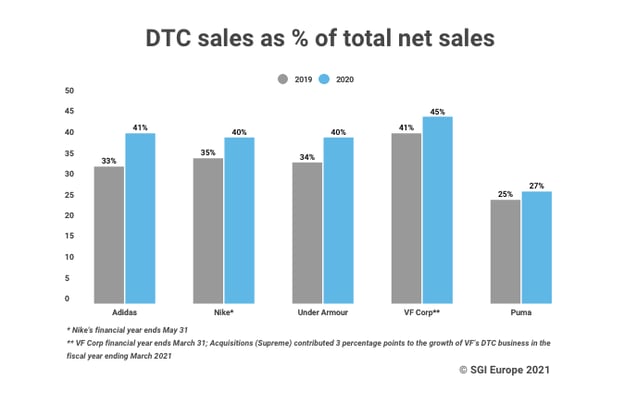

Nike and Adidas are starting to switch up their wholesale partnerships and focus on their direct-to-consumer DTC channels. In 2019, for instance, Nike left Amazon.

What does this mean for other athletic footwear retailers?

Since localization is seeing huge gains, favoring a DTC approach will only facilitate this approach, while keeping data within the brand's ecosystem.

For the athletic footwear market, the 25 fastest-growing DTC footwear sites saw a 64% bump in total traffic in Q3 of 2021 compared to the year before.

In short, a DTC approach for athletic footwear brands will look like:

But what about marketplace brands?

In our Activewear webinar, we ask how multi-channel brands like Top4Sport are coping with a DTC approach.

Don't forget to sign up for the webinar by clicking on the CTA at the end of this article!

For DTC to succeed in the resale market, athletic footwear brands are beginning to leverage peer-to-peer resale. Which will empower customers and give back autonomy to the shopper at the end of the funnel.

That’s a WRAP, people!

Throughout this article, we’ve tackled the athletic footwear market by looking at the categories of running shoes and sneakers.

To sum up, we can conclude that the four main reasons behind purchasing athletic footwear are as follows:

Before you’re done waiting for the shoe to drop, why don’t you hear from other activewear brands about how they’re expanding into the athletic footwear market?

Our Activewear webinar hears from eCommerce leaders at Puma, HEAD, and Top4Sport. Together with Crobox’s CEO, we tackle:

Register for the webinar below to secure your spot! 👇