Looking at the outdoor apparel industry through market analysis, trends, and top purchasing decisions.

Looking at the outdoor apparel industry through market analysis, trends, and top purchasing decisions.

The other day, I went fishing with my Dad.

(We didn’t actually, that would be way too cliche, but picture it for me, would you?).

The sun is shining. Dad is wearing a fisherman’s hat.

I’m wearing waterproof pants and wellies, so I can step into the water whenever I want. We’re also both wearing utility vests with loads of pockets designed to store bait, barb, and line.

Two days later, I’m at a party in the city.

I see this guy wearing a bucket hat and the same utility vest!

Without thinking twice, I go over to him and yell ‘DO YOU ALSO FISH?’ in his ear.

But, of course, with the rise of gorpcore into mainstream fashion, this guy doesn’t fish. Also, the girl at the bar wearing Solomon trainers isn’t back from trail running. In fact, puffer vests are the go-to jacket for your average city dweller.

When I look around…bucket hats are EVERYWHERE.

Outdoor apparel has gone from functional to fashion. This is what makes it such an interesting category in the activewear retail industry.

With that in mind, this article will give a concise analysis of the outdoor apparel industry, with a focus on Gorpcore.

For a more in-depth industry report on activewear, with a deep dive into trending product categories like outdoor, athleisure, and athletic footwear, read the Activewear Report.

Hook, line, and sinker! Let’s get started.

Outdoor apparel consists of performance-enhancing clothing and footwear for activities that can only be practiced outdoors.

Sports and activities such as fishing, hiking, rock climbing, sailing, kayaking, cycling, surfing, etc. This usually encompasses outdoor ‘gear’ including (but not limited to) coats, jackets, fleece, sweatshirts, rain pants, etc.

In the past few years, the outdoor apparel market has been booming. Today, it’s poised to grow even more, hence the emergence of two things:

To understand the DTC market in the context of the activewear market, be sure to check out our activewear industry webinar! 👇

Why has this become such an opportune market to study?

Moncler’s Ready To Wear 2019 collection…they named it, not us.

According to the UK Environment Agency, the average UK person plans to spend fourteen hours outdoors during a typical week over the summer.

Emerging activities that are of growing interest include bird-watching, gardening, and fishing.

The CAGR (compound annual growth rate) of the outdoor apparel industry is actually predicted to accelerate at a rate of 5.3% from 2021-2026.

According to Retail Touchpoints, even after the pandemic consumers have a vested interest in outdoor activities. And these ‘adventurers’ usually shop for products that are:

In the US, 48% of the population participates regularly in outdoor activities. Hiking in 2020 was up 171% compared to the previous year.

Sure, this has to do with people taking more outdoor holidays during the pandemic. But it’s almost like this trend isn’t a passing fad.

Outdoor apparel brands that have prioritized technically superior products that are also sustainable are suddenly hype.

While outdoor activities became more of a norm during the COVID-19 pandemic, more people are also choosing active holidays.

So the impulse for purchasing outdoor apparel is twofold:

We’ll take a look at shopper behavior in the outdoor apparel industry later on.

Statista forecasts the outdoor activewear market to be a $19 million industry by 2026.

Top brands include:

In fact, these popular brands show a mix between legacy (Columbia) and DTC (Arc’teryx).

Legacy brands that have often operated within a niche can now sell selective gear to the average consumer.

As predicted, these brands are driving the (CAGR) of the outdoor apparel industry by 4.6% between 2022 to 2028.

Which seems likely. Consumers trust companies with a track record of specializing in performance-enhancing gear.

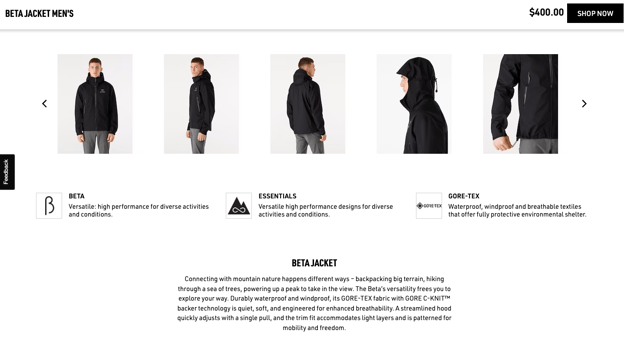

Arctery’x Winter jacket

Especially when it comes to winter sports: Here, you need products that will keep you,

Which is why, these past years, the outdoor apparel market also had a spotlight on winter sports.

For example, the Fall Winter 21 runway show focused on puffer jackets, knitted balaclavas, and apres-ski loungewear.

Chanel featured salopettes inspired by winter sports.

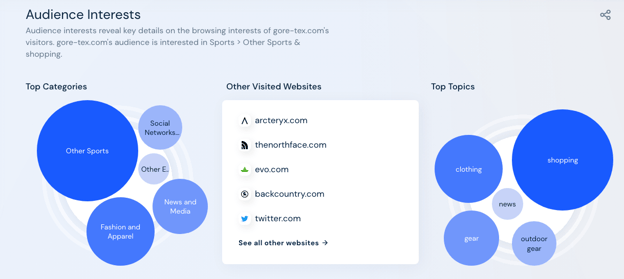

One of the most popular activewear brands of the winter season, Arc’teryx, is considered by High Snobeity as,

‘the sleekest gear on the market, the Range Rover of techwear. Stylish, expensive, and beastly at the core.’

💡 Did you know?

In data gathered on one of our outdoor apparel brands, we found that men are more likely to shop for skiing and snowboarding apparel, with everyday outdoor taking a backseat (although this could be seasonal). Women, on the other hand, chose trekking before skiing and snowboarding.

Remember when we went fishing earlier on?

Wearing bucket hats and utility vests, we weren’t exactly the picture of sexy.

But today, outdoor apparel is dismembered from its dad-gear perception. In other words, it’s no longer clunky but chic. In other other words, ‘Gorpocore’.

This kind of chic outdoor gear is dubbed ‘Gorpcore’, inspired by the name for trail mix when hiking (‘Good Ol’ Raisins And Peanuts’).

According to Grailed, Gorpcore is camping-chic and focuses on wearing utilitarian, functional, outdoor gear every day.

In short, Gorpcore clothing is practical and functional, but also stylish. Skiing

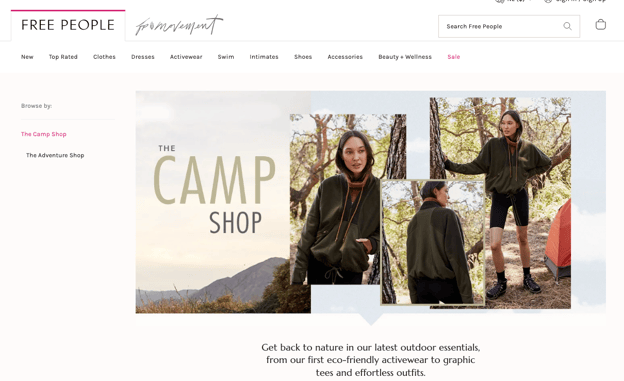

To chart the success of this trend, even non-outdoor brands feature outdoor themes in their campaigns.

Urban Outfitters sent a camping-themed email showcasing a breadth of products like sandals and trail shorts. Free People has a dedicated Camp Shop page offering outdoor essentials.

Urban Outfitters ‘Gone Camping’

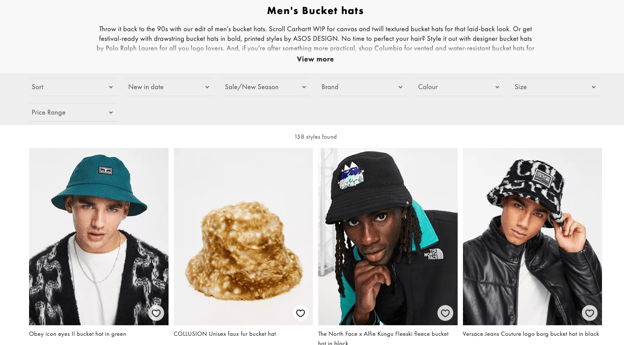

Bucket hats have actually seen a 51% increase in searches on eBay and 16.4% of the American population have now actually been fishing more than once.

But, as the gorpcore trend validates, consumers don’t buy activewear products to suit their outdoor activity needs. The strange popularity of bucket hats is a good example of this.

Karl Lagerfeld brought the bucket hat to the runway in 2018, once again deconstructing the boundaries between high fashion and activewear.

Or, in other words, bringing gorpcore to the forefront of the activewear industry.

💡 Did you know?

For one of our activewear brands, we tested a Product Finder to understand more about outdoor apparel shoppers.

- 68% of users were looking for technical outdoor gear

- 21% of users were looking for outdoor apparel only for everyday use

- Only 11% were looking for technical gear that can be used every day

This disproves the Gorpcore hypothesis but is easy to explain. People using a Product Finder on an outdoor apparel webshop will be more goal-oriented and therefore look for technical products. The attribute ‘waterproof’ was 4x more chosen than ‘windproof’.

On the whole, our data found that the majority of Product Finder users were making choices based on technical outdoor activities; i.e., mountaineering, trekking, and skiing.

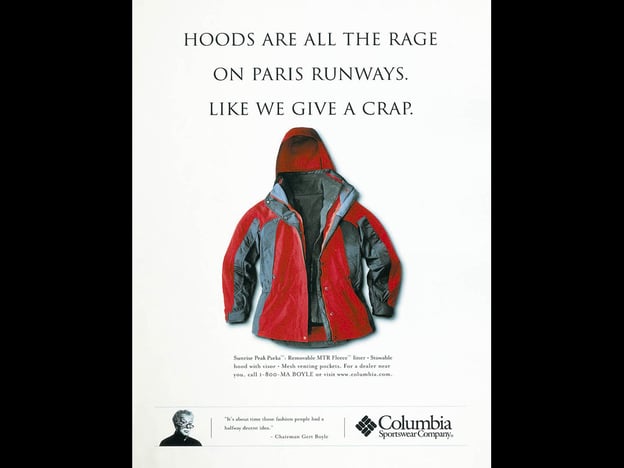

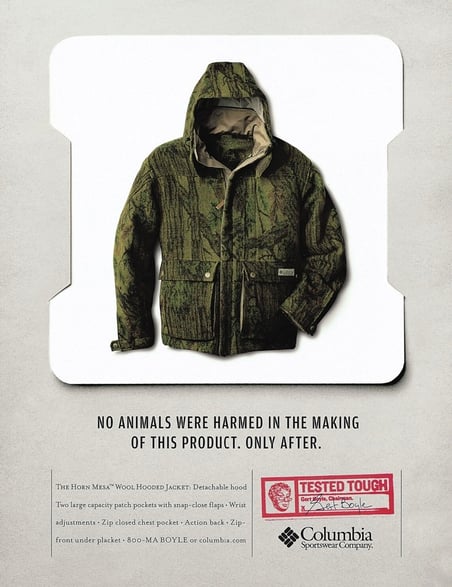

Columbia ad validates the controversy surrounding Gorpcore for actual outdoor brands. Many see this product sell as mildly inauthentic, since gear isn’t actually being worn in the conditions it was made for.

Performance-enhancing attributes and sustainability lead to the creation of outdoor apparel. But it really is Gorpcore that is mainstreaming these products.

When products go from functional to fashionable, we enter the realm of psychology. Understanding why people shop for outdoor apparel products is an important factor when considering the market as a whole.

With the help of our in-house behavior experts, here are the top purchasing decisions behind buying outdoor apparel.

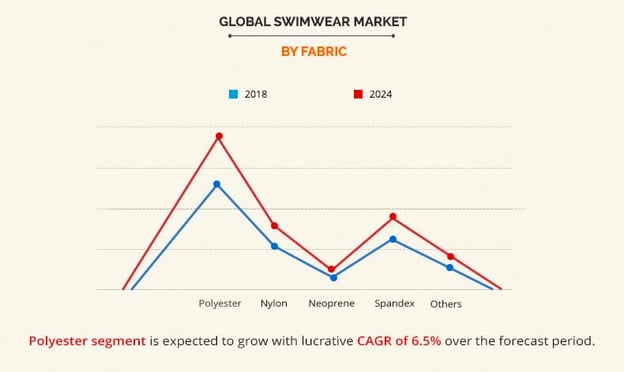

The waterproof breathable textiles market is projected to reach $2.3 billion by 2027, growing at a CAGR of 4.4% over seven years.

Consumers want comfort when they shop and wear outdoor gear. Especially as the top three outdoor activities that are popular in the market at the moment are:

All of these activities require specific, comfortable gear.

Vogue says that fleece, waterproof pants, and utility backpacks have had a revival in their design and popularity.

In 2021, Fortune predicted the rise of ‘workleisure’, with the sale of cozy, stretchy, and all-around comfortable clothing taking over. When it comes to outdoor apparel, this trend is key.

Brands that can contribute to making customers feel comfortable while they participate in outdoor activities (including leveraging performance-enhancing attributes) are coming out on top.

According to Edited, brands should ‘pair seasonal color palettes and silhouettes with high-performance materials and products’ (including products like swimwear).

In 2019, Carhartt generated over $1 billion in revenue, the ultimate cross between functional clothing and fashion (their cargo pants have multiple pockets made for multi-environment durability).

Just like comfort then, clothes that provide a good middle ground are great at driving shopper behavior.

But these attributes should be clearly communicated.

Having incredibly technical products is one thing. But turning these attributes into benefits is how you will win your segment.

Patagonia has long been popular with outdoor aficionados. Their mission has always been solid: Protect the planet at all costs.

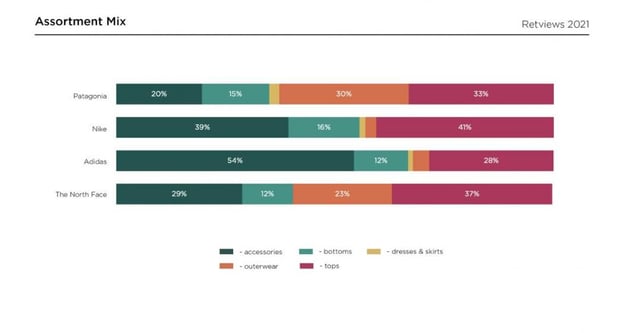

It’s so political that it’s almost in your face – but it works. Patagonia holds 30% of the share of outerwear products compared to other outdoor apparel brands.

Unlike other activewear brands, they place outerwear as a top priority, with green activism at the core of their marketing.

Protecting the environment isn’t just a marketing stint. Brands that actually show real progress in their sustainability goals are recognized by consumers.

Nature is the foundation of outdoor activities, and for outdoor brands to really excel in this market they need to keep this as their core message.

More consumers are spending time outdoors because they realize this is also contributing to better mental health.

Outdoor brands that connect better mental health, physical activity, and protecting the planet are the ones that see more shopper loyalty.

In this article, we’ve covered:

But this is only touching the surface of the outdoor apparel market. For more on how the activewear industry is competing (trends, psychology, and opportunities), download the activewear report below👇.

Now that you have an idea of the outdoor apparel industry, and why it’s growth is here to stay – what’s next?

If you’re working within eCommerce, turning product attributes into benefits, and guiding shoppers to the right outdoor products made for them is key.

Read the activewear report for more, or check out how Crobox’s Product Finders can help you do just that.